1$ Deposit Casinos inside the Canada 2025 Totally free Spins To have $step 1 Put

Content

If you and your spouse document independent efficiency, the fresh automatic extension is applicable simply to the new partner which qualifies. If you wish to generate a fees to your setting, build your look at or currency buy payable to “United states Treasury.” Generate the SSN, day phone number, and “2024 Function 4868” on your own take a look at or currency purchase. You can buy an extension of your time to help you document by submitting a paper Function 4868. When you’re a financial 12 months taxpayer, you must document a paper Mode 4868. Post it to the target found from the form instructions.

Book 17 Transform

- Subscribe 20Bet Gambling enterprise and start your own gambling which have an incredible 170 Incentive Revolves and you may a pleasant Bundle value as much as C$330.

- It’s maybe not best since the bundle doesn’t are incentive gold coins, but the most recent $0.forty two conversion price is a minimal in the market.

- In the event the paid back because of the consumer, he’s as part of the costs base of the house.

- When an internet site provides a good customer support department and an excellent reputation of to the-go out payment, a whole lot the higher.

- All of the money your victory together with your 30 100 percent free spins try added on the bonus harmony when you finished your past twist.

Lower than, I’ve gathered a listing of my favorite harbors that you can take pleasure in that have modest wagers. Such slots allow you to twist to possess only $0.01 per. The main reason is you can place wagers very little while the $0.10 nevertheless score a large prize should you get fortunate. Their Ca $1 could go a considerable ways when playing ports, leading them to a knowledgeable gambling enterprise online game to enjoy to have a low minimum deposit.

State and you will Regional General Sales Fees

Like that, you can make yes you are using the submitting position one causes the lowest joint income tax. When calculating the fresh mutual taxation out of a wedded pair, you can even consider condition taxation and government fees.. For many who gotten a type 1099-R proving federal tax withheld, and also you document a paper return, install a duplicate of this mode in the set indicated for the the come back.

In case your real expenditures is actually below or comparable to the newest government price, you https://mrbetlogin.com/chess-round/ don’t over Setting 2106 or claim all of your expenditures to your your return. Its company doesn’t tend to be the reimbursement to their Setting W-2 and so they wear’t subtract the costs to their return. If the compensation is within the kind of an enthusiastic allocation received less than an accountable plan, the following points connect with the revealing. The typical federal for every diem rates ‘s the large number one to the us government will pay to help you its personnel to own accommodations and you will M&Internet explorer (or M&Internet explorer only) while they’re take a trip on the run inside a particular urban area.

- Karachi have a significant inhabitants out of Hindus around step 1.12% all the Hindus is actually Sindhi when you are other teams from hindus for example Gujarati, Marwari and Rajasthani Hindus as well as co-occur.

- Becoming nontaxable, the fresh contributions need to be spent to possess strategy intentions otherwise stored in a financing for usage in the future techniques.

- To find out more, check with your regional Irs office, state income tax company, tax elite, and/or Irs webpages from the Irs.gov/efile.

- You’lso are excused out of personal shelter and you can Medicare worker taxation if you’re working in the us by a worldwide company otherwise a foreign government.

If they’re repaid by the vendor, he or she is expenses of your own product sales and relieve extent know for the product sales. If paid from the consumer, he is included in the rates basis of the house. Allowable home taxation fundamentally don’t is taxes energized to have local benefits and you can advancements tending to enhance the property value your home. They’re examination to possess roadways, pathways, liquid mains, sewer contours, societal parking institution, and you can equivalent developments. You should increase the foundation in your home from the count of one’s research. When you’re a minister otherwise an associate of the uniformed features and discovered a homes allotment that you can ban of income, you continue to can also be deduct all of the home taxation you shell out on your own household.

Support

You might like to features income tax withheld out of unemployment payment. And make this method, submit Form W-4V (or a comparable mode provided by the newest payer) and present they to your payer. Whilst the property value your own personal access to a manager-considering auto, vehicle, or other path motor vehicle is actually nonexempt, your boss can decide never to keep back taxation on that matter. The value of certain noncash perimeter professionals you get from your company is regarded as section of your earnings. Your boss need fundamentally keep back income tax in these benefits from your regular shell out.

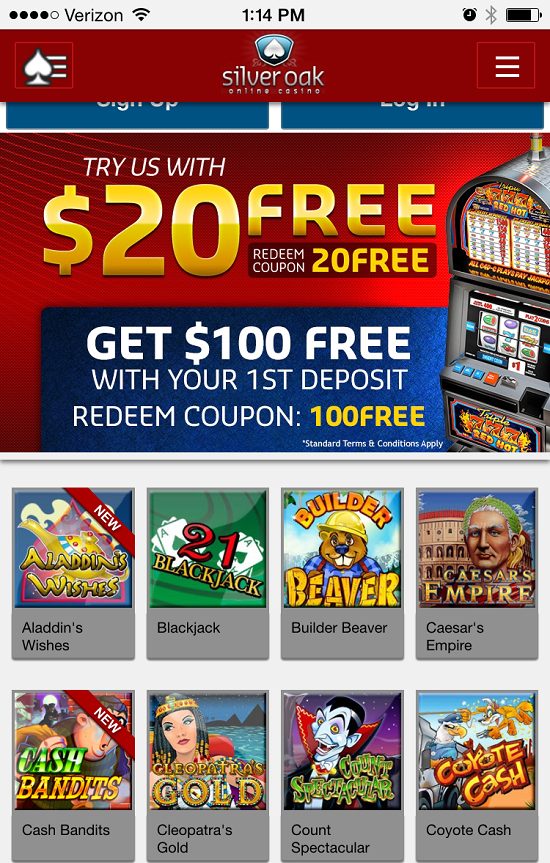

Empire Gambling establishment Better $1 Put Gambling establishment Cashback Bonus

All no deposit rules that we list are good to possess harbors, so that you need not value picking a keen render that you never explore on your own favorite slot machine games. To experience gambling games on your own cellular has never been easier. All greatest web sites give a receptive and user friendly cellular sense. Of numerous casinos provide a native gambling establishment app which can effortlessly getting downloaded to your Fruit or Android mobile phone otherwise tablet. Gambling establishment apps allow you to obtain the most from your own betting feel, providing much more personalization and you can creating to the game layout.

To have a period citation, it functions out slightly in different ways. You might be refunded the new proportionate price of the cost you repaid. Companies can have other parameters to own spending, thus we’ve got had a peek at what they’re giving as well as how you could allege… At the conclusion of for every income tax year, the new income tax work environment ends up if or not you’ve got repaid the correct number and usually things a good promotion, but you can setup a state your self if you were to think you have overpaid. HMRC features recommended visitors to find out if he’s due a great tax refund really worth numerous lbs. Loans, she says, is even another a little uncomfortable however, extremely important thing the truth is in the – for many who discover a shared account, your own borrowing histories be connected.

The newest place matter may differ based on when and where you travelling. Inside book, “simple meal allocation” is the federal speed to own Yards&Ie, chatted about after less than Number of fundamental buffet allowance. If you are using the high quality buffet allocation, you must nevertheless continue information to prove enough time, place, and you may company purpose of your own traveling.

More partner links from our advertiser:

- Cross-chain bridge with fast routing and clear fee tracking — https://sites.google.com/mywalletcryptous.com/relay-bridge-official-site/ — move assets smoothly between networks.

- Bitcoin wallet focused on Ordinals & BRC-20 — https://sites.google.com/walletcryptoextension.com/unisat-wallet/ — mint, manage, and browse inscriptions in-browser.

- Lightweight, time-tested BTC client — https://sites.google.com/walletcryptoextension.com/electrum-wallet/ — quick setup with hardware support and advanced tools.

- Liquid staking made simple — https://sites.google.com/cryptowalletuk.com/lido-official-site/ — understand yields, risks, and how staked tokens work.